Home refi with bad credit

Typically mortgage lenders want to see a credit score of 620 or better for a refinance but there are some refinance options if you have poor credit including streamline programs. Some have features unavailable from federal loans including 100 financing ie no down payment seller contributions no income limits and no mortgage insurance requirement.

How To Refinance Mortgage With Bad Credit 3 Options Available

The VA IRRRL or VA Streamline Refinance is an easy way to lower the rate and payment on your VA loan.

. FHA LOAN TERMS FOR MOBILE. A cash-out refinance typically comes with. Your Guide To 2015 US.

You now may need a higher credit score larger down payment and lower debt-to-income ratio to qualify for a home loan. I highly recommend E Mortgage Capital if you want to deal with direct lender when purchasing or refinancing your home loan. A cash-out refi is an alternative to a home equity loan.

Traditional banks and credit unions may offer competitive rates but its also a good idea to check with direct home mortgage lenders and mortgage brokers. A home equity line of credit is a type of revolving credit in which the home is used as collateral. Refinancing with Box Home Loans is fast and easy.

Mortgage rates fluctuated greatly so far in the third quarter of 2022 with the average 30. How to Refinance with Bad Credit. Improve your credit score.

If your low credit score is preventing you from refinancing here are some tips that may help. Despite these inconveniences the pandemic has also made certain aspects of the mortgage process more accessible. Fannie Mae HomePath.

Because the home is more likely to be the largest asset of a customer many homeowners use their home equity for major items such as home improvements education or medical bills rather than day-to-day expenses. Minimum FHA Credit Score Requirement Falls 60 Points October 11 2018. While a refi isnt the only way to get funds for a home improvement project it means you arent paying service on extra debt unlike say with a home equity line of credit or a second mortgage.

How much cash depends upon your home equity how much your home is worth compared to how much you owe. The better your credit score the lower the interest rate a lender will likely grant you and. The FHA has a program that lets FHA loan applicants get financing or refinancing for the purchase of mobile homes a developed lot for the mobile home or the combination of the home and the lot.

When shopping for a bad credit mortgage keep a few things in mind. To get a home equity loan with bad credit youll need more income more home equity and less total debt than someone with good credit. Private lenders also offer mortgages for folks with bad credit.

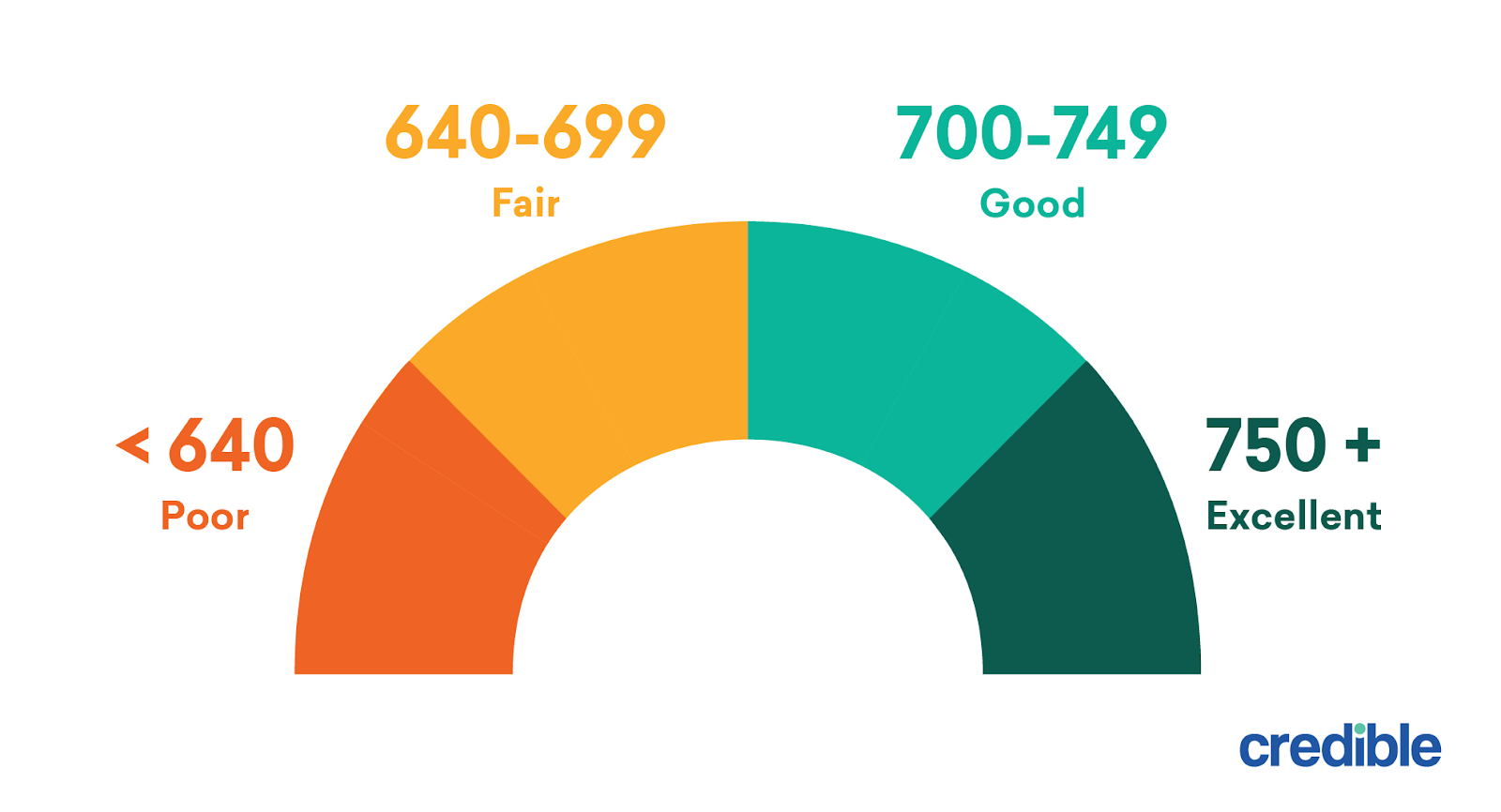

Good credit scores begin at 670. Mortgage brokers work with multiple lenders and can help evaluate the types of home loans available to you. Dont miss out on historic low rates.

You also might consider a cash-out refi for home improvements or to pay for a childs education. Along with the average home price you can also view the Single-Family Housing Permits statistics and the Multi-Family Housing Permit statistics. Homeowner Tax Deductions.

Best uses for your home equity Will mortgage rates go down in September. This loan is typically a home equity loan HEL or home equity line of credit HELOC. And that leaves the last 10 which represents the buyers down payment amount 10 of the purchase.

Now in 2021 you can get a mortgage at an interest rate of 3. Select programs like the government-backed Streamline Refinance can help borrowers refinance with. Checking your rate online wont affect your credit.

If you sell the home after only a few years or refinance the mortgage or pay it off buying discount points could be a money-loser. Moris Wasosa It is such a blessing in my life and that of my family with a minimum investment of 600 sure to make your withdrawal of 7200. Funding for Purchase or Refi.

While your credit score is just one factor mortgage lenders will consider when youre buying a home with bad credit its weighed heavily because it represents your risk to lenders. Whats more not everyone needs great credit or perfect finances to qualify for a refinance. See todays VA IRRRL rates and rules.

Here is an example of how discount points can reduce costs on a. Credit problems self-employed recent bankruptcy or foreclosure no problem. Say your home is valued at 200000 and your mortgage balance is 100000 giving you.

Home Equity Lines of Credit Calculator Why Use a Heloc. Loan Pioneer works with people good as well as fair poor and even bad credit scores to help them get quick access to 5000 or less cash. Getting a bad credit home loan with a low credit score.

If current mortgage rates are low or your credit scores are below minimum standards for a home equity loan a cash-out refi program may be a good alternative. Virtual home tours have risen in popularity as have electronic mortgage closings. Credit bureau Experian doesnt use the term bad credit but it does consider any score below 580 to be very poor credit.

Minimum credit scores vary among. Like other FHA loan products the mobile home must be considered the primary residence of the FHA borrower. Lets say that 10 years ago when you first purchased your home interest rates were 5 on your 30-year fixed-rate mortgage.

Axos Bank requires a great credit score above 700 offers loan amounts of 5K to 50K reputable lender FDIC insured bank. Average credit scores range from 580 to 669. But youll want to make sure you dont end up paying more in mortgage interest than the interest you would pay on any debt youre using the cash to pay off.

There are multiple credit scoring models but most lenders use FICO Scores created by the Fair Isaac Corporation. Just be sure to pay close attention to fees as well as rates. Office Retail Mixed-use Medical Office and more.

Check to see whether you could save money by lowering your monthly payment with a no-cost refinance or Get cash-out from the built up equity in your home. If you have an existing VA backed home loan you can refinance even with bad credit with a no-hassle Interest Rate Reduction Refinance Loan IRRRL also known as a VA streamline refinance.

What Are Your Refinancing Options If You Have Bad Credit Lendgo

Can You Refinance A Car Loan With Bad Credit Lantern By Sofi

Refinancing With Bad Credit 6 Questions To Ask Zillow

How To Refinance A Mortgage With Bad Credit Money

Options For Refinancing Your Home With Bad Credit Forbes Advisor

Cash Out Refinance 500 Credit Score How To Get Approved

Home Refinance Learning Course From Financial Experts Bankrate

Cash Out Refinancing Pros Cons Alternatives

Pin By Adam Kahn On Mortgage Tips Fha Mortgage Mortgage Loan Officer Mortgage Tips

640 Credit Score Mortgage Rate What Kind Of Rates Can You Get Credible

How To Refinance A Home Loan If You Have Bad Credit Credit Sesame

8 Best Mortgage Refinance Companies Of Sept 2022 Money

5 Ways To Refinance Your Mortgage With Low Credit Score Nfcc

750 Credit Score Mortgage Rate What Kind Of Rates Can You Get Credible

Cash Out Refinance With Bad Credit 3 Ways To Get Approved

Money Refinance Mortgage Mortgage Loans Refinancing Mortgage

Can I Refinance My Mortgage With Bad Credit Nerdwallet